CLICK HERE TO VIEW ORIGINAL WEB PAGE AT SUPPLY CHAIN 247

In today’s fast-changing retail-industry environment, warehouse automation can be a surprisingly powerful tool for meeting new supply-chain challenges head on and using the supply chain to create competitive advantage. By David Welch, Rune Jacobsen, Pierre Mercier, and Robert Souza | Supply Chain 247

Retailers today face many threats to their traditional ways of doing business.

New competitors, overcapacity in the industry, demanding customers in a sluggish economy, multichannel growth—such forces are combining to create pressure both to achieve greater operational efficiency and cost savings and to innovate and grow. In this climate, retailers are increasingly using the supply chain to drive competitive advantage.

Among the many options for improving supply chain performance, warehouse automation is one whose benefits, though potentially great, are in many cases only partly understood.

Thanks to recent and ongoing technological innovations, the benefits of warehouse automation are more accessible than in the past, and they can be used to drive value throughout the supply chain and to open up strategic options.

Achieving Warehouse Savings

Most retailers are well aware of the warehouse operations (“four-wall”) savings enabled by automating processes such as putaway, retrieval picking, sorting, and palletizing. The automation of these processes can improve labor efficiency and quality control and save on other equipment, materials, and expenses. The four-wall economics are a function of scale and labor costs, which is why retail operations with high throughput and labor costs, such as case-pick grocery facilities, have been most likely to automate. Automation also has been easiest to justify in a growing retail space in which additional distribution-center space is needed, and the cost of new construction can be amortized over this growth.

Although achieving four-wall savings from warehouse automation might seem relatively straightforward, evaluating the potential savings is more complicated than many people realize. One reason for this is the dramatic differences in investment costs for automation, depending on the complexity and scale of a warehouse operation and the particular solution chosen. Choosing which processes and items to automate can also have immense implications for fixed costs and project risk.

To properly evaluate the benefits of such investments, executives must consider an extensive set of factors. In our experience, holistic investment-decision models for warehouse automation include several dozen inputs, which incorporate a variety of financial and operational considerations.

Beyond Four-Wall Savings

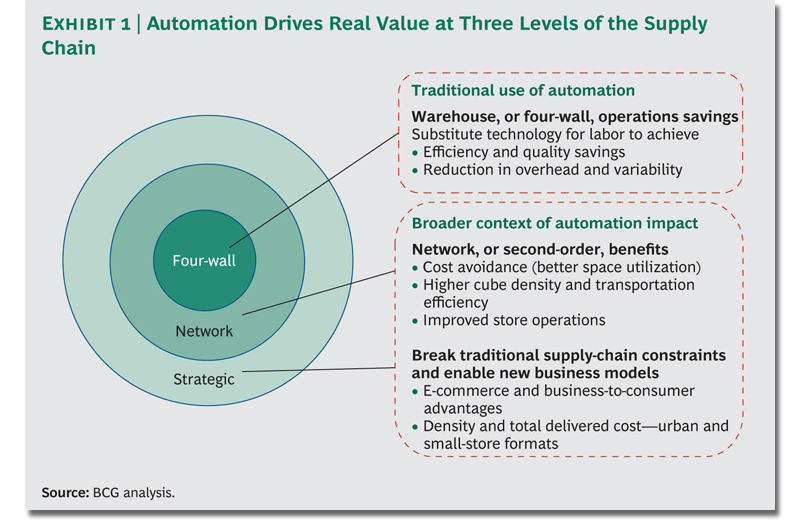

Potential four-wall savings are often top-of-mind considerations for retail executive teams, but teams should not be trapped into thinking that these savings are the only source of value from automation. Warehouse automation can also enable improvements to the broader supply-chain network and, even more dramatically, enable a range of previously unimagined strategic options. (See Exhibit 1.)

The potential benefits of warehouse automation exist throughout the supply-chain network. Consider these examples of benefits at three key points in the network:

- Warehouse. Dramatically improved utilization of storage space reduces the need for new construction as greater warehouse capacity becomes needed, and facilitates centralization of warehouse operations and closing of buildings.

- Transportation. The ability to assemble denser pallet cubes through automation means more tightly packed trucks and lower average shipping costs per item, reducing transportation costs by up to 10 percent.

- Store Backroom. Store-specific pallets (assembled to reflect the layout of a particular store) can reduce shelf replenishment labor, with store operations savings estimated at up to $0.02 per case.

Beyond such network improvements, warehouse automation can be used to open up new strategic options and initiatives for retailers. For example, automation can enable growth by allowing a distribution center to service more stores and increase product offerings. Sobeys, a Canadian grocery chain, for example, cut case-handling costs in half while adding capacity by constructing a state-of-the-art automated distribution center. The new facility positions Sobeys to invest in low-cost growth in the future.

Reducing cycle time through warehouse automation is another strategic benefit. By speeding up the queuing and batch-planning, order-picking and packing, and transportation processes, automation can dramatically reduce order-to-delivery cycle times. This improved cycle time in turn reduces inventory, improves fill rates, minimizes lost sales that can reduce customer satisfaction and loyalty, and can even eliminate the need to maintain distribution center stock altogether.

Finally, automation can be a key lever for strategic growth and is particularly well suited to help unlock the value of retail e-commerce. Traditionally, e-commerce has presented daunting problems associated with complexity, cost per order, and customer responsiveness, and automation can mitigate some of these challenges. For instance, automation solutions can reduce the costs and complexity of SKU growth through the use of dynamic or virtual pick slots.

Reasons to Act Now

Now is a good time to reconsider preconceived ideas about automation, as a number of factors are combining to make the value of automation, including its potential strategic value, more accessible than ever before. Competition among solutions providers and lower space requirements for automation technology are resulting in lower costs. Higher throughput and other automation-related performance improvements, coupled with lower costs, are increasing potential return on investment (ROI).

More processes can now be automated than in the past, and individual machines can handle a greater variety of tasks. In many instances, installation flexibility allows for brownfield warehouses to be retrofitted, reducing real estate costs. And the scalability of today’s systems means that investment in additional capacity can be deferred until needed. In still other situations, investment in automation can help mitigate the risks of labor supply constraints, shocks, and regulation.

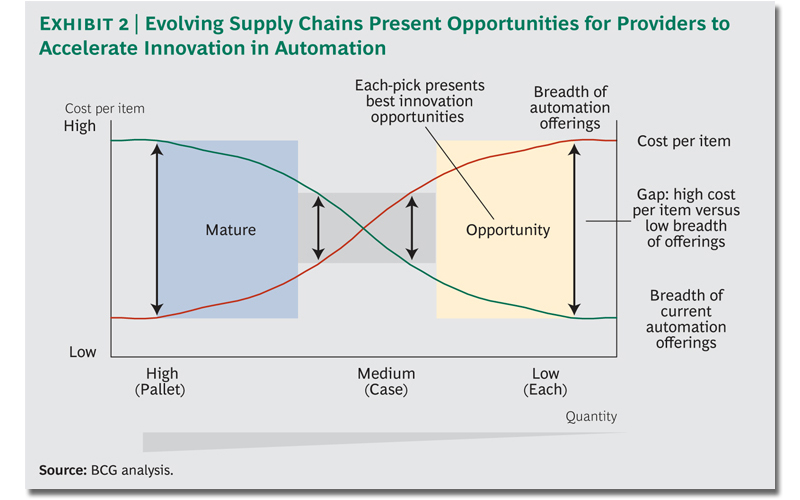

Underlying all of these developments is the automation industry’s increasingly successful effort to address the variability of warehouse process needs. The evolution of automation solutions is being driven, in particular, by the most variable and expensive warehouse process—picking and sequencing. While case-pick solutions have been the focus of the most recent wave of innovation, there is an opportunity for further innovation with each-pick solutions. (See Exhibit 2.)

With the value from warehouse automation becoming more accessible, there are other compelling reasons for retailers to act now. As with any other new technology, the experience curve in automation rewards early movers. Additionally, several of today’s automation providers are hungry for business, which can result in creative pricing opportunities.

The pressures on today’s retailers to reduce costs, improve service, and find ways to innovate and grow are a call for action on supply chain performance and even on operations strategy itself. A shift in strategy, in turn, presents an ideal opportunity for considering how well a company’s infrastructure serves its business needs. Conversely, an infrastructure improvement such as automation can also begin conversations throughout the supply chain that can lead to transformational change.

Evaluating Possible Solutions

A company that is evaluating ways of improving warehouse efficiency and decides to automate has essentially three options to consider: semiautomated process improvements, established fully automated storage-and-retrieval systems, and second-generation solutions reflecting the latest innovations in the industry. Along with various differentiating factors that are more or less obvious, a key distinction among these options is that the first two involve well-defined constraints that the newer automation systems have significantly eased:

Semiautomated Process Improvements. These require less investment than full automation, but they provide fewer benefits. Although such solutions can increase picking productivity, track order progress, and reduce errors, they keep labor-intensive processes in place. Semiautomation is typically an appropriate option for smaller-scale operations.

Fully Automated Storage-and-Retrieval Systems. Established systems offer proven, lower-risk ways of improving labor efficiency and quality control and have been used effectively by early movers in automation such as Kroger, Zara, and Nike. Incremental improvements in performance and design over the years have added value. Yet these systems also entail constraints. For one thing, the large up-front costs typically require scale to generate positive ROI. For another, traditional systems, though configurable, are costly to change once installed, and retrofitting brownfield, nonautomated warehouse space requires construction of new buildings. Traditional automation systems also have large space requirements for the installation of conveyor networks and cranes to automate case handling.

Second-Generation Solutions. The constraints involved in semiautomated and traditional fully automated systems greatly enhance the attraction of newer solutions that, although less established at this point, can enable companies to create significant value by breaking these constraints.

Related Video: Robotics Solutions for Materials Handling Applications (and Warehousing)

In today’s fast-changing retail-industry environment, warehouse automation can be a surprisingly powerful tool for meeting new supply-chain challenges head on and using the supply chain to create competitive advantage. Evaluating automation’s potential impact requires a company to answer the following questions with rigor and careful analysis:

- How can automation drive value? It is essential to consider the full value potential, including improvements to the broader distribution network and expanded strategic options—not just how to save the warehouse money.

- When will the timing be right? Although marketplace turmoil and uncertainty will cause some to hesitate, these same conditions make this a good time to get ahead of competitors—especially now that the value from warehouse automation is more accessible than ever before.

- What solution will drive the most value for the business? The impressive degree of innovation among automation providers today offers solutions that address a wide variety of needs, making it critical that you understand the needs of your own organization.

- Will our execution maximize potential? It can and will, with analysis and planning that never loses sight of the full value potential of automation.

Overall, the automation solutions being pioneered by new providers are having significant impact on the retail industry by opening up new cost savings and strategic options: lower-scale requirements that provide smaller players with greater access to automation’s value; brownfield installations and other lower-cost solutions made possible by second-generation technology that enable positive ROI in flat or declining retail environments; and lower costs and footprint requirements that make more efficient use of vertical storage and may enable the use of local distribution hubs in higher-cost locations for players such as urban small-format retailers.

Avoiding the Pitfalls

Warehouse automation, although it is by no means new, shows great potential for driving value through the supply chain and enabling new strategic options. Yet many pitfalls put the potential value at risk. Companies have wasted tens of millions of dollars by acquiring technology that does not meet their needs, or, as a result of faulty implementation, they have failed to realize automation’s full potential value.

Failing to consider the strategic context of a rapidly changing industry has led to investment decisions that constrain future options. In general, evaluating the investment options thoroughly is a highly complex task, and third-party expertise is often needed to tease out the differences among available technologies and consider all of the potential sources of value to a business. Executives may select the wrong evaluation criteria—focusing, for example, on the size of the return without adequately considering the timing. They may also underestimate execution risks, such as organizational resistance to change, and the time needed to align suppliers on new technologies.

Such experiences remind us that realizing the untapped value in warehouse automation requires savvy analysis, sound planning, and disciplined execution. Coop, a food retailer in Europe, provides an example of the rigorous process that should be used to determine whether warehouse automation is a good investment and what sort of investment should be made. Coop’s process included thorough analysis to quantify potential value at each key decision point.

For example, a strategic review of alternatives and the potential ROI from each found that centralizing and automating distribution center operations would yield the highest net present value. A proposal process yielded a shortlist of suppliers with the necessary technical capabilities that were then evaluated using detailed measures of ROI, risk, and qualitative factors. A disciplined process and thorough evaluation finally led to the selection of Witron, a leading vendor of warehouse automation solutions.