According to a recent study, most innovations in supply chain management build on existing achievements and reconfigure known methods and technologies rather than invent new ones and suggest inapt innovations can do more harm than good. By Jim Rice, January 19, 2014, Supplychain247.com

Revolutionary innovations capture the imagination and motivate people. But how many supply chain innovations (SCI) are truly revolutionary?

Not many, according to a recent study of SCI carried out by the MIT Center for Transportation & Logistics (MIT CTL)*.

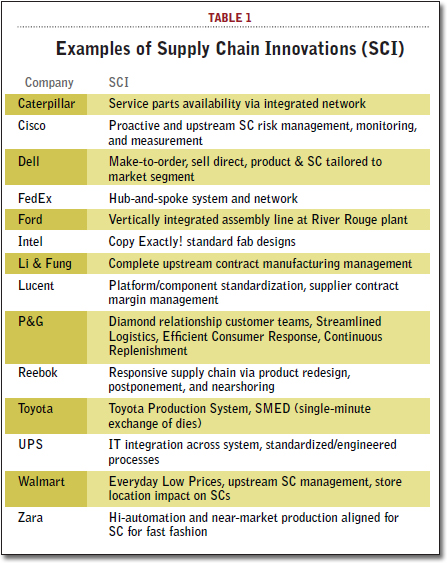

Most innovations in supply chain management build on existing achievements and reconfigure known methods and technologies rather than invent new ones. That doesn’t mean SCI is unexciting or largely irrelevant. On the contrary, incremental change represents one of the most powerful weapons companies have to stay ahead of the competition (see table).

And, of course, some SCI’s do redefine markets. But in order to fully harness SCI, companies must distinguish between the steady and step-change varieties, and understand what it takes to implement them in terms of the organization’s strategic objectives. Inapt execution of an innovation can lead to costly missteps, particularly in today’s fast-paced competitive environment. Recall, for example, how companies misjudged the potential of early-stage RFID applications.

Let’s explore the nuts and bolts of SCI in an effort to help supply chain practitioners properly evaluate and exploit innovations. But first, let’s take a closer look at the difference between “cool” innovations that bring drastic change and incremental advances that move companies forward at a steadier pace.

Contrasting Strategies In his seminal work “The Innovator’s Dilemma,” thought leader Clay Christensen describes two types of product innovation: sustaining and disruptive. Sustaining innovations make products better through, say, lower prices or added features, thus sustaining the enterprise’s market position. Disruptive innovations change the product offering by redefining the value proposition.

SCI can be sustaining or disruptive, too. And although process innovations tend to follow a different path than those in the product world, there are some important parallels.

For example, our research indicates that sustaining SCIs improve the process, perhaps by lowering costs, shortening cycle times, and raising the quality bar. These innovations also help to sustain a company’s competitive position.

Similarly, just as disruptive innovations change product offerings, so too do disruptive SCIs change the product process. More specifically, they are evident when an organization challenges or changes the dominant design. While the supply chain does not actually alter the product, it can change how the offering is produced and delivered to customers.

The “dominant design” is a concept developed by MIT professor Jim Utterback to explain the evolution of product markets. Utterback’s work highlights how product and process innovations follow different evolutions. Briefly, in the early stages of a new product, multiple variants of the process often emerge as process innovation increases. Eventually these variations coalesce into a common or dominant process design. Some time after that, the evolutionary pace trails off and the opportunities for significant change diminish until the next “Big Idea” comes along.

Some innovations can be both sustaining and disruptive. For instance, the Dell computer product line that was tailored to suit a clearly defined customer segment can be considered a sustaining innovation; it made demand more predictable and the supply chain more efficient. Yet, when Dell designed its supply chain to make-to-order and ship-direct at a time when virtually all other large manufacturers were producing to stock (i.e. the dominant design) and selling through retail, these constituted a disruptive SCI because the shift changed the process used for production and distribution.

Zara’s strategy to co-locate its design and production centers in close proximity to end markets created efficiencies that made the apparel company’s process quicker and more responsive; that was a sustaining SCI. At the same time, the coupling of a high-automation, near-market, fast-cycle time with a vertically integrated supply chain represented a disruptive SCI. The new model challenged the dominant design of low automation, remote manufacturing, long cycle time, and an outsourced supply chain.

The Wrong Fit While many of us are captivated by SCIs that challenge the dominant design, in reality, most SCIs are sustaining. This is consistent with the time-honored operational goals of speeding up product introductions, lowering costs, and improving quality. These goals have been called many things including business process reengineering (BPR), continuous improvement, cost cutting, and kaizen.

The name is not important—but a clear understanding of the core processes is essential. Leaders tend to be inspired by disruptive SCIs (even though they often confuse them with product innovations), and demand dramatic change even when they lack a thorough understanding of the processes involved. In some cases senior executives may not appreciate that a sustaining strategy is the better choice, and requires a different approach to those needed for radical disruptive strategies.

Another stumbling block to achieving disruptive change is that embracing this type of SCI is very difficult. We believe that disruptive SCIs represent the supply chain equivalent of Christensen’s Innovator’s Dilemma. On the one hand, market-leading supply chains have to operate at an economic scale, and be efficient as well as consistent. On the other hand, adopting a disruptive supply chain design tends to upset the status quo and undermine the supply chain’s performance.

To further complicate the picture, taking the safer or more convenient sustaining option can be the wrong choice in some situations. For example, a CPG company attempted to enter an emerging market by using a high-volume production system for a highly sophisticated consumer product. The strategy was unsuccessful. Consumers could not afford to buy the product, sales volumes were too low to warrant the high-volume approach, and the production system depended on an underdeveloped supply base.

A radical departure from the dominant design was needed. That was one that required the company to design and manage a low-volume, emerging market supply chain for which it had no expertise. Fortunately, a local supply chain operative created a cost-effective, low-volume operation to serve the local market—much to the company’s surprise.

The Cost of Confusion The above example illustrates a broader and more serious outcome of misjudging the type of innovation required in a given competitive situation: The subsequent failure of an inapt innovation deters companies from pursuing market opportunities.

In the case of the CPG Company, making a lower quality product based on a low-volume supply chain probably never occurred to the organization. These leaders were forced to experience deep failure before they could see and embrace the potential that existed with a disruptive SCI. Most enterprises are not so lucky.

Before pursuing an SCI, a company has to be clear about the objective; is the goal continuous improvement to maintain market position with a modest increase in margin or to disrupt the industry? Many managers get starry-eyed over the latter objective but actually need to target the former.

Corporate leaders intent on pursuing disruptive SCIs should prepare for a roller coaster ride because the disruptive forces unleashed may affect their company. Still, being aware of consequences like these can prepare the enterprise for the adventure. And as mentioned, the majority of SCIs tend to be sustaining. We ought to pursue these innovations aggressively and cheer their successes, whatever we call them.

About the Author Jim Rice joined the MIT Center for Transportation and Logistics (CTL) in 1995 and he was appointed as the Deputy Director of the Center in 2007. In this capacity he oversees several research and outreach programs, CTL Executive Education Programs and outreach marketing activities. Jim serves as the Director of the MIT Integrated Supply Chain Management (ISCM) Program, a collaborative research consortium with industry sponsors.

Editor’s Note: This is the first in the series of Innovation Strategies columns from the MIT Center for Transportation & Logistics. In the coming issues, MIT CTL will explore the development and implementation of innovative supply chain solutions and practices.