CONTRIBUTION BY MICHAEL R. BLUMBERG – CERTIFIED MANAGEMENT CONSULTANT (CMC) AND PRESIDENT & CEO OF BLUMBERG ADVISORY GROUP

The Depot Repair Industry encompasses a wide variety of enterprises, ranging from original equipment manufacturers to third party service providers and from single location companies to those with numerous shops across the US, Canada, and Mexico. The types of products repaired include telecom, computers, servers, printers, and smart phones.

To better understand where this complex industry as a whole excels and where improvement might be warranted, Blumberg Advisory Group conducted a survey examining a number of key performance indicators (KPIs) in financial, production, and quality aspects of depot repair.

In the following pages, we discuss the results of this survey and address the key issues that affect many enterprises engaged in depot repair. The analysis consisted of determining the industry average (median) and best in class (90th percentile) performance for a variety of financial, production, and quality key performance indicators. In addition, similarities and differences were examined for the following demographic characteristics:

- Company Size (as measured by number of facilities)

- Company Business (OEM/ODM or Third Party)

- Financial Structure (Cost Center, Profit Center, Revenue Center)

- Average Cost per Repair (less than $250 or greater than $250)

- Purchase of Enterprise Software in the past two years or not

Survey Results

The survey, conducted in August and September of 2013, included independent service organizations, original equipment manufacturers, third party repair firms, electronic manufacturing service providers, and distributors.

| Figure 1

|

|

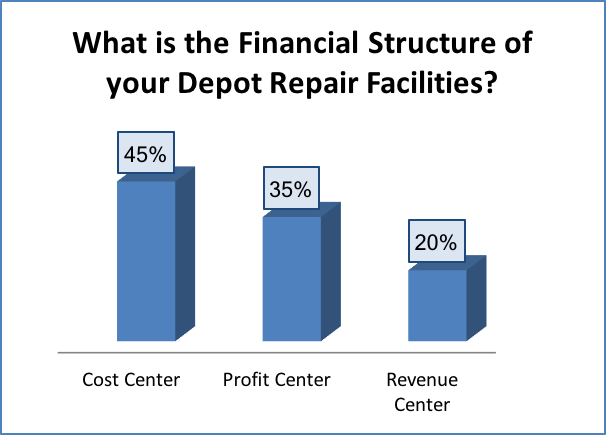

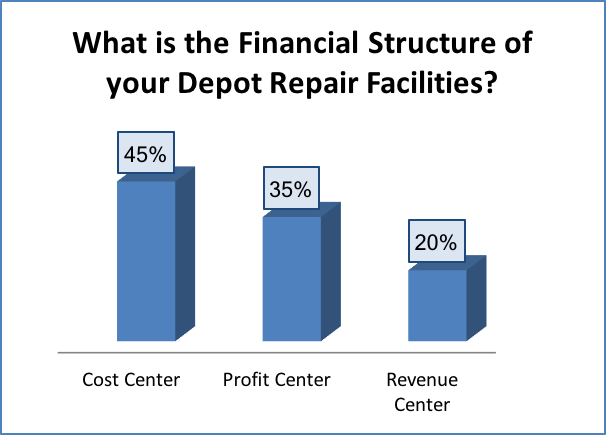

The results indicate that companies are split in how they account for their depot repair financially. Based on the 2013 benchmark survey results, 45% of respondents view their depot repair as a cost center, 35% as a profit center, and 20% as a revenue or contribution center (Figure 1).

In terms of the types of equipment that depot repair companies support, the most common type of equipment supported was IT (55.9%) followed by “Other” (44.1%). The “Other” category included equipment such as controllers, automotive diagnostic tools, industrial products, and guitars. Equipment types that were less commonly supported included printers/scanners/faxes (20.6%) as well as consumer electronics such as MP3s, televisions, and digital cameras (17.6%). See Figure 2 for the complete list of equipment types that are supported by the depot repair companies that participated in the benchmarking survey.

| Figure 2

|

|

Financial Performance KPIs

As part of this survey we evaluated KPIs associated with a Depot Repair organization’s financial performance. The KPIs were used to examine inventory turnover, costs of service, and overhead costs (Table 1).

Interestingly, industry average and BIC for all KPI questions related to overhead and materials costs tended to be quite similar between different types of depot repair companies. The range value for BIC was always the best (lowest) one, and even the values for industry average tended to be on the better (lower) end of the range spectrum. These findings indicate that depot repair companies tend to keep their overhead and materials costs low (as a % of their total revenue), regardless of their specific company characteristics.

Table 1: Financial Performance KPIs

| KPI |

Definition |

2013 Benchmark |

| Industry Avg. |

BIC |

| Inventory Turnover |

Annual cost of goods sold / Inventory value |

4.4 |

8 |

| Direct Depot Repair Labor Costs as a % of Total Depot Repair Revenue (%) |

Direct Labor Costs / Total Depot Repair Revenue |

16.01 to 19 |

Less than 10 |

| In-Direct Depot Repair Labor Costs as a % of Total Depot Repair Revenue (%) |

In-Direct Labor Costs / Total Depot Repair Revenue |

Less than 18 |

Less than 18 |

| IT Support Costs as a % of Total Depot Repair Revenue (%) |

IT Support Costs / Total Depot Repair Revenue |

Less than 10 |

Less than 10 |

| Materials Costs as a % of Total Depot Repair Revenue (%) |

Materials Costs / Total Depot Repair Revenue |

18.01 to 22 |

Less than 18 |

| Engineering and Quality Support Costs as a % of Total Depot Repair Revenue (%) |

Engineering and Quality Support Costs / Total Depot Repair Revenue |

Less than 5 |

Less than 5 |

While overhead and materials costs tended to be similar between depot repair companies, direct depot repair labor costs (as a % of total revenue) often differed dramatically between different types of companies. For example, when examining the financial structure of a depot repair company, the direct depot repair labor costs were much lower for revenue centers (industry average less than 10%) and cost centers (10% to 13%) compared to profit centers (more than 19%). There was also a sharp contrast between companies who identified themselves as OEM/ODM, where depot repair labor costs (between 10% to 13%) while companies who identified themselves as third party repair firms had direct labor costs of more than 19%. Just as with overhead and materials costs, however, the BIC for direct depot repair labor costs was always less than 10%, regardless of company characteristics.

Inventory turnover was also often dependent on specific company characteristics. Companies that charged less than $250 on average per repair had a much higher turnover (industry average of 5.9 and BIC of 8) than companies that charged more than $250 on average per repair (3 and 4.6). A depot repair company’s financial structure was also a factor, with cost centers having a much higher turnover (5.9 and 7.6) than profit centers (2 and 6.2) and revenue centers (4 and 4.8). Finally, companies who manufacture their own equipment had a higher turnover (3.8 and 6.8) than third party companies (2 and 6.2).

Production and Quality Performance KPIs

The KPIs used to examine the efficiency and service quality of depot repair companies are identified in Table 2.

Table 2: Production and Quality Performance KPIs

| KPI |

Definition |

2013 Benchmark |

| Industry Avg. |

BIC |

| Avg. # of units repaired per week per bench tech |

Total # of units repaired by bench techs per 5 day week / Total # of bench techs performing repairs per 5 day week |

25 |

59 |

| Avg. Repair Yield (%) |

Total # of units repaired / Total # of units processed |

90 |

98 |

| Avg. NFF Rate (%) |

Total # of units where reported mode of failure could not be verified / Total # of units processed |

15 |

4.4 |

| Avg. Repair Time per Unit (minutes) |

Total time worked during 5 day work week / Total # of units repaired during 5 day work week |

60 |

13 |

| Avg. Turnaround Time (days) |

Avg. total time from receipt to available in finished goods inventory |

10 |

2 |

| Avg. DOA Rate (%) |

Total # of units that were incapable of being repaired / Total # of units processed |

2.8 |

0.6 |

In the depot repair industry, large enterprises have the reputation for being highly efficient and lower cost operations, while small companies have the reputation for being skilled craftsmen. The analysis of the survey data showed that those advantages were in fact differences between large and small enterprises (as measured by the number of depot repair facilities) and that there are tradeoffs associated with those assets.

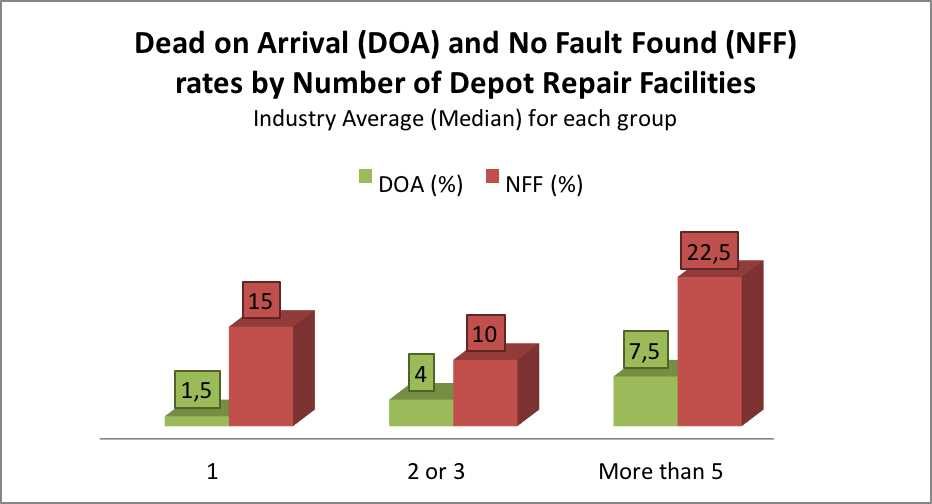

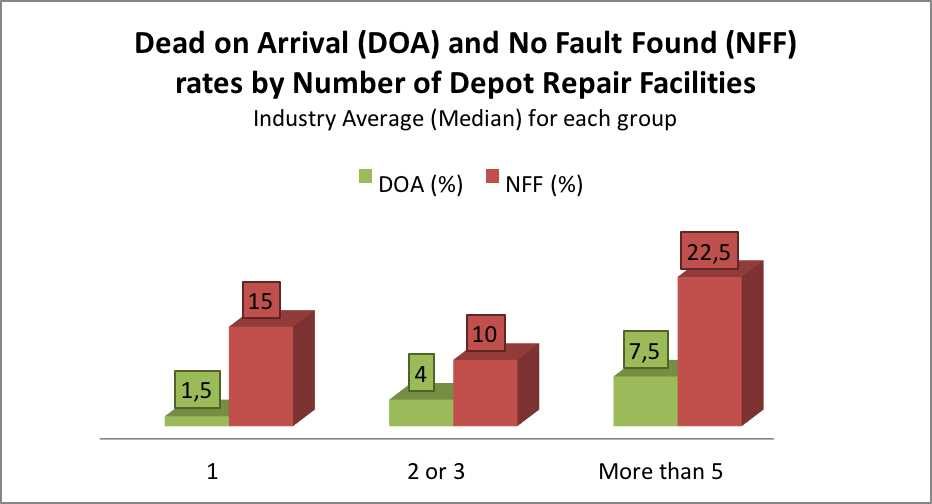

As seen in Figure 3, companies with 5 or more repair facilities had significantly more units repaired per week by each bench technician. This result is supported by how much faster bench technicians repair each unit in large companies. Since direct labor costs are a major component in the costs of service, faster repair time is a decided advantage for larger companies.

| Figure 3

|

|

Small and medium sized companies, however, have advantages in lower Dead on Arrival (DOA) and No Fault Found (NFF) rates than larger companies (Figure 4). The advantage of having lower DOA and NFF rates can be seen in the average repair yield, which is much higher for small (92%) and medium (92.5%) enterprises relative to their larger counterparts (85%). This is likely a result of the fact that when bench technicians spend more time examining a unit under repair, they are more likely to detect the actual causes of equipment failures, resulting in a higher likelihood of repairing the equipment.

| Figure 4

|

|

Companies who have recently purchased enterprise software (within the past 24 months) may be disappointed to see that while their DOA rate is lower, they have slower repair times and lower repair yield. Since research shows that it takes 51% of companies 1 to 2+ years to fully implement their enterprise software program and another 35% of companies 6-12 months (The Real Impact of ERP Systems in the Public Sector, June 2012 by Microsoft Dynamics), it is not surprising that the full benefit has yet to be seen. If this survey is repeated in 2015, the benefits of enterprise software are expected to be more evident.

Table 3: Production and Quality Performance KPIs by Enterprise Software

| KPI |

Enterprise Software |

| Industry Average (Median) |

Best in Class (90th Percentile) |

| Did Purchase |

Did Not Purchase |

Did Purchase |

Did Not Purchase |

| Avg. # of units repaired per week per bench tech |

25 |

23 |

136 |

52.4 |

| Avg. DOA Rate (%) |

2.5 |

4 |

0.2 |

1 |

| Avg. Repair Yield (%) |

85 |

95 |

96.2 |

98 |

| Avg. Repair Time per Unit (minutes) |

90 |

52.5 |

25.8 |

9.5 |

Conclusions

The depot repair industry should be rightfully proud to see that overhead and materials costs are relatively low (as a % of total revenue). Further, the best in class performance is consistently in the lowest (best) category for all financial KPIs (regardless of company characteristics), so the cream of the industry is comprised of all types of companies: large and small, OEM/ODM and third party, etc.

Smaller companies tend to be skilled craftsmen, as is evident by great repair yield and low DOA and NFF rates. The tradeoff is that their repair times tend to be slower. Conversely, larger companies tend to be highly efficient with lower costs of service. The tradeoff for this advantage is higher DOA and NFF rates, and therefore a lower repair yield.

While the long term benefits from implementation of enterprise software were not evident in these results, the external data supporting implementation is very compelling and future benchmarking surveys are expected to show that to be true for the depot repair industry as well.

Conducting these types of benchmarking studies is useful and continuing to assess industry performance every two or three years would be appropriate.