CLICK HERE TO VIEW ORIGINAL WEB PAGE AT SUPPLY CHAIN 247

By Robert C. Lieb | Supply Chain 247

Over the past 25 years, the third-party logistics (3PL) industry has evolved from an emerging industry to a global best practice, setting the stage for the next 25 years of dynamic change.

It’s hard to imagine today, but in the late 1980s, third-party logistics (3PL) was relatively new.

Today, of course, logistics outsourcing has become an important option for logistics managers in many manufacturing, retail, wholesale, and service settings.

The functions performed by 3PL service providers can encompass the entire logistics/supply chain process, or, more commonly, selected activities within that process.

Back then, few businesses were outsourcing their logistics processes to third parties. Nor were many professionals researching or writing about this emerging field. A few articles discussing the concept had appeared in academic and professional publications, but relatively little academic attention had been devoted to the concept at that point.

At that time, I was intrigued by the concept of logistics outsourcing. It was unclear to me how widespread the practice had become, but I believed that if it achieved any significant scale it might fundamentally change the logistics landscape. I also believed that the field was ripe for academic research.

In 1990, I submitted a proposal to United Parcel Service Foundation seeking support for a survey of the vice presidents or directors of logistics of the Fortune 500 manufacturers to determine the extent to which they were outsourcing logistics services – and if they were, how it had affected their operations.

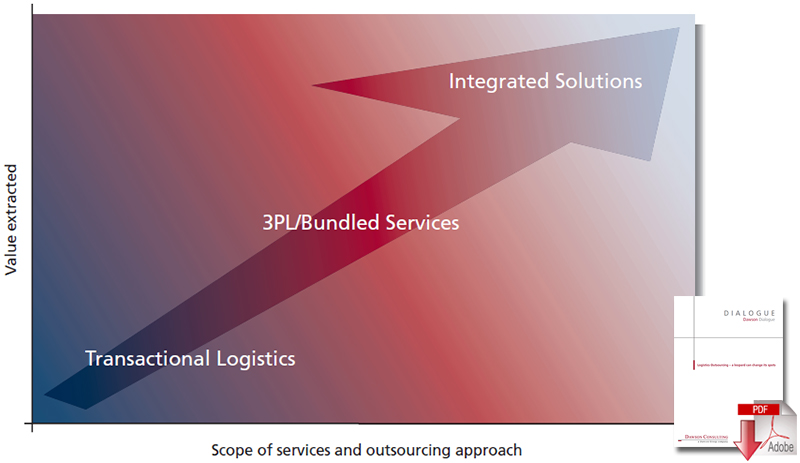

Integrated Solutions offer improved opportunities for the extraction of value

The initial response from the Foundation was essentially: “Why should we care about that subject?” My response was that if the 3PL concept gained traction in the logistics marketplace, United Parcel Service would probably want to establish an operation in that space. That appeared to strike a responsive chord. Soon after, the Foundation provided the support I sought, and I developed and administered the first survey conducted of 3PL users. It should be noted that UPS subsequently established UPS Supply Chain Solutions, a business that now generates more than $5 billion in annual operating revenues for the company.

The results of the first user survey were published in the Journal of Business Logistics (JBL) in 1992. While I initially thought this would be a one-time survey, the response to the JBL article was surprising. Literally every day after the article appeared, I received calls from companies considering the use of 3PL services, executives from existing 3PL companies, and individuals and companies considering entry into the 3PL industry. That led me to consider doing similar surveys of that group of companies on an annual basis. Yet, I had no idea that 25 years later I would still be conducting research into a global industry that now annually generates operating revenues of nearly $750 billion.

My co-authors and I subsequently conducted annual surveys of Fortune 500 companies from 1994 until 2003. Over that period we also conducted three similar surveys of large manufacturers in Europe and one in Australia. Within a relatively short period of time, other scholars in the United States and many other countries began doing very similar surveys of 3PL users that focused on a variety of other user groups.

After having conducted surveys of Fortune 500 Manufacturers for nearly a decade, we decided to examine the other side of the 3PL equation – 3PL service providers. Generating provider data would give us another perspective on the status and evolution of the 3PL industry.

While there were thousands of companies in the United States that considered themselves 3PLs, we made a decision to once again focus on large companies. In particular, the focus was to be at the CEO level of many of the largest 3PLs serving the North American marketplace. The survey format was again used, and the target group for the first survey was the CEOs of the 20 largest 3PLs serving the North American marketplace. The first North American 3PL CEO survey was conducted in 1994 and all 20 CEOs agreed to participate. An annual North American 3PL CEO survey has been conducted every year since, and in 1995 we decided to add a similar 3PL CEO surveys in Europe.

Several years later an annual 3PL CEO survey was added covering the Asia Pacific region. All three of the 3PL CEO surveys are still conducted each year. By adding the surveys in Europe and Asia we have been able to document regional similarities and differences in the global 3PL industry.

What follows are the most important observations we have made based on the data generated in the 3PL user and 3PL CEO studies over the past 25 years.

We hope that they are of value to future scholars and to those companies that provide and use 3PL services to better understand the industry’s evolution and its future potential.

CSCMP 2014: Dr. Robert C. Lieb 2014 3PL Provider CEO Perspective from Alen Beljin

The User Studies: 25 Observations

- The initial use of 3PL services is generally triggered by specific events. Those trigger events include such changes as mergers/acquisitions, corporate reorganizations, changes in leadership, and the emergence of serious financial problems. Subsequent trigger events can also lead to expansion of the scale of the 3PL services used by companies already using 3PL services.

- The mandate to consider the use of 3PL services most often comes from corporate presidents, and/or CEOs and CFOs. The process of considering the use of 3PL services typically involves a cross-disciplinary team that includes such groups as logistics, manufacturing, finance, IT, and human resource management. At that stage concerns are often expressed about managing the potential change, the related loss of control, downsizing the workforce, and possible overselling by the 3PLs being considered.

- If a decision is made to use 3PL services, the initial buy usually involves a limited range of services and/or a limited geographical area. There is risk involved in outsourcing logistics activities and most companies move deliberately in doing so.

- While many early 3PL relationships are essentially operational or tactical in nature, they often evolve into strategic relationships between the two companies.

- The concept of logistics outsourcing is now much more widely accepted and used than it was when I conducted the first user survey. At that time 38 percent of Fortune 500 Manufacturers surveyed indicated they used 3PL services. That number now exceeds 80 percent of those companies, and the percentage of the logistics spend given to 3PLs by such companies has also increased significantly over time. 3PL use also continues to grow substantially in other areas such as retailing and distribution, with increasing 3PL focus being given to the medical device and pharmaceutical sectors of the health care industry.

- There is now a substantial database about the benefits that have been realized through 3PL relationships, not only in terms of cost reduction and service improvements, but also in terms of possible return of capital under certain circumstances such as transition to use of provider facilities and/or equipment.

- 3PL user needs have evolved over time. In many instances, needs have become much more complex due to shifts in manufacturing, sourcing, selling and delivery practices, and the related globalization of business. Large users have often used their leverage to convince their 3PLs to follow them into new markets.

- As a result of such factors, many of the buys are now much broader in terms of services used, geographical coverage, and contract scale.

- Over time 3PL buyers have generally become better prepared and more sophisticated in the 3PL selection process. The process has become more clearly defined, and the user community has a much better understanding of logistics/supply chain management issues and options. In many companies, the procurement group has become more heavily involved in the 3PL selection process, and the related cost focus of the procurement types has often required more emphasis on value-selling by 3PLs.

- Many 3PL relationships have problems at the implementation stage because the parties fail to clearly articulate expectations and metrics before starting the engagement. The desire of users to have the 3PLs “hit the ground running” is often the root cause of those problems. Those problems have become somewhat less common as users and providers have come to understand the importance of this pre-work.

- Initial 3PL use typically leads to a reduction in user head count and the workforce reductions tend to increase as the size of the buys increase. Companies deal with this in a variety of ways including buyouts and retraining programs. It is also quite common for 3PLs to hire employees of their new customers to not only reduce their own staffing requirements, but also gain the operational knowledge and intellectual capital of their customers.

- 3PL users must exercise caution in terms of the extent of their dependence upon 3PLs to avoid dumb-sizing of their internal intellectual capital in the logistics/supply chain area. Companies that cut internal human resources too deeply often have real problems in not only managing the relationship with the 3PL, but also in developing related internal strategies.

- Recessions don’t necessarily harm 3PL relationships. In fact, in many instances they actually improve the relationship. Our data has suggested that in times of significant economic downturns nearly one-third of those relationships improve as the parties focus on collaborative problem solving and seek mutually beneficial solutions to their problems.

- The natural disasters of the past several years have demonstrated that many 3PL customers had not effectively developed business continuity plans and/or natural disaster recovery plans. That experience, coupled with the related financial and market position impacts, has led many users to rethink their strategies in those areas and broaden their supply base both numerically and geographically.

- Most major 3PLs have made substantial commitments to environmental sustainability goals in the past decade. While many existing and potential 3PL users believe that is important, to this point it is not a major factor in the selection process. However, that may be changing. Many 3PL sustainability programs are now yielding direct customer benefits, and users are increasingly asking 3PLs to examine their operations for potential sustainability improvements.

- Increasingly, 3PL users are looking to their logistics service providers to promote integration along their supply chains by also providing services to their key vendors and customers. In many instances, 3PL provision of a common IT platform has played a significant role in promoting that integration.

- Early 3PL users typically expected relatively little from their 3PLs in terms of IT support and systems. Now, many expect comprehensive provider IT systems and expertise from those companies.

- Reflecting not only the pace of economic change, but also experience with global recessions and natural disasters, many 3PL users want greater 3PL flexibility and agility – both in terms of operations and contracts.

- They also expect 3PLs to be proactive in identifying ways of modifying processes and activities to yield cost and service benefits.

- As long-term collaborative relationships have emerged in the 3PL industry, it is now increasingly common to have gain-sharing and pain-sharing provisions in 3PL contracts.

- In pursuing cost and service improvements, many 3PL users now work with 3PLs to explore possible shared-use concepts with 3PLs. That concept has already gained considerable traction in the European market for 3PL services.

- While some users have reduced the number of 3PLs used, in many instances they are forced to use multiple providers due to the breadth of their needs. In response, many 3PLs offer 4PL or LLP services to clients to help manage those multiple relationships.

- Not all 3PL relationships work well. When they fail, users generally migrate to another 3PL rather than bring those activities back inside their organizations. However, during the past several years some European companies have brought outsourced activities back inside as a means of redeploying employees who had become redundant due to the region’s prolonged economic downturn. It is much more difficult to sever such employees in Europe due to stringent government regulations.

- Many 3PL relationships have been long-term in nature, with some having gone through multiple contract renewals. It is not uncommon for contracts to be automatically renewed if agreed upon performance metrics have been met. Under those circumstances there is typically a related price increase to protect the provider against inflation.

- When I began studying the 3PL industry in 1989, many viewed the use of logistics outsourcing as a radical departure from business as usual. That perception is no longer common. The 3PL industry has not only expanded in scale and become global in nature, it has also broadened its service offerings to meet the needs of an ever-changing marketplace. Logistics outsourcing is now an important strategic option for companies across a broad range of industries seeking to improve logistics costs and service levels while accessing the expertise of companies who, in some instances, have been in the industry for decades.

The 3PL CEO Studies: 25 Observations

- Most major global 3PLs initiated operations as subsidiaries of transportation and warehousing companies that concluded there was a market for a broader range of service offerings to their customers as the margins on their traditional services were declining. Many of those 3PLs were relatively new to the industry when I began doing 3PL research in 1989.

- Initially, the 3PLs were controlled quite closely by their corporate parents and were often required to use the services of their parent companies in developing solutions for their customers. However, over time many 3PLs have developed greater autonomy as customers questioned whose needs the 3PLs were most concerned with – their customers or their corporate parents.

- The structure of the 3PL industry continues to evolve, and it has changed dramatically over the past 25 years. Mergers and acquisitions, some initiated by private equity companies, continue to be the major drivers of that structural change. In many instances, those transactions have been followed by significant post-acquisition problems such as systems incompatibility, redundant employees and facilities, and clashes in corporate cultures. The extent of the industry restructuring that has occurred is demonstrated by the fact that only seven of the 20 large 3PLs included in my first 3PL CEO survey in 1994 still exist as independent companies.

- The scale of the 3PL industry has increased tremendously since my first CEO study was initiated in 1994. At that time, many of the companies perceived as the major players in the industry were generating annual operating revenues in the tens of millions of dollars. In many instances those companies now have annual operating revenues well in excess of a billion dollars per year. Collectively, the annual revenue base of the global 3PL industry is now estimated to be nearly $750 billion.

- The 3PL industry is now global in nature with many major global markets being served by large multinational 3PLs as well as local providers. Initially, most of those large companies operated in one of the three major markets – North America, Europe, and the Asia Pacific region. Now, with few exceptions, the industry’s dominant players operate in all three regions. In many instances the movement of the 3PLs into foreign markets was driven by the requirements of their key customers as they expanded their global sourcing, manufacturing, and sales activities. To a great extent 3PLs still follow key customers as they shift their global locations.

- The growth and market entry strategies used by large 3PLs still varies widely depending upon the market being entered and its stage of economic development. Those strategies have included direct investment, acquisitions, business alliances, and joint ventures. In some situations, local regulations require foreign 3PLs to initially have a local business partner.

- When 3PLs have relied upon business alliances and joint ventures to expand their service offerings and geographical coverage, they often subsequently acquire their “partners.”

- The service offerings of today’s large 3PLs continue to expand. While they initially reflected the services offered by their corporate parents, they have become far more robust over time stretching far beyond traditional logistics services into such areas value added activities, financial services, trade compliance, and support of purchasing activities and contract manufacturing.

- Many long-term 3PL relationships are collaborative and strategic in nature. Initially they were primarily operational and tactical in nature. When asked what factors are most important in fostering such collaboration, the CEOs have most often cited common culture/trust, effective communications/information support, and common goals and objectives.

- Over time, large 3PLs have become far more customer selective. Based on negative experiences during global economic downturns and natural disasters, they spend substantially more time and effort in “qualifying” new customers. They have learned that not all customers are good customers.

- Large 3PLs now tend to focus on a limited number of verticals, usually five or six. Generally they include automotive, electronics, and fast moving consumer goods. In the early stages of the industry’s development, those companies often attempted to be all things to all customers. They now understand that cannot be done and that the expertise to develop a defensible market niche requires substantial time, talent, and resources.

- Large 3PLs now routinely sell along the supply chains of key customers, linking them with their suppliers and customers. In doing so they play an important role in supply chain integration for those companies.

- Over time, those 3PLs have clearly demonstrated their ability to reduce supply chain costs and improve service levels, and in many cases have fostered a return of capital to users. In most instances, that has involved customer use of 3PL facilities and equipment and the sale of the customer’s related assets.

- Large 3PLs remain concerned about commoditization of the industry and are increasingly emphasizing brand management. That involves efforts to differentiate themselves from their competitors in the marketplace. The differentiation strategies used by those companies have varied widely and have emphasized such things as their “greenness”, their expertise in specific industry verticals, their IT systems, and their experience in particular geographies.

- Many of these companies now supply and manage leading edge IT applications on behalf of their clients. Early 3PL users did not expect that level of technology and expertise from their providers, but in many situations those are now “must haves.” Meeting the current level of customer expectations has necessitated development of internal intellectual capital in that space and large scale investments. One chronic problem related to this development is the continuing reluctance of customers to pay the full cost of those services.

- 3PLs now face an increasingly sophisticated and structured buying marketplace, with more corporate purchasing involvement in buying decisions. That has not only generally lengthened the sales cycle, but also led to the need for 3PLs to place greater emphasis on “value selling.”

- With few exceptions, during the past decade large 3PLs have made steadily increasing commitments to environmental sustainability goals. In some instances pursuit of those goals has subsequently led to lower costs for not only the 3PLs but also their customers. As noted earlier, some companies have attempted to use their environmental programs to create market differentiation. However, at this point relatively few customers consider the “greenness” of a particular 3PL to be a major factor in either expanding their use of 3PL services, or using them for the first time.

- The large global 3PLs are quite resilient. In recent years, they have had to deal with major global recessions and natural disasters while meeting the needs of their customers. Those challenges have been formidable, often leading to lower earnings, asset redeployment, and layoffs. In some instances, “asset light” companies have fared better than those with a much larger asset base, because of their ability to more easily scale back operations. However, in either case the industry’s largest companies have generally responded very well to those challenges and ultimately recovered financially.

- Reflecting upon those experiences, collectively those 3PLs now place much greater emphasis on business continuity planning, and they are increasingly asked to discuss those plans with potential customers. In many instances, those plans now must be outlined in responses to customer RFPs.

- Many of these companies have embraced and effectively used social media to pursue both internal and external company goals. Various forms of social media including Facebook, Twitter, and YouTube have been used for such diverse purposes as recruiting, soliciting customer feedback, sending emergency messages to employees and customers, and providing company updates to the business community.

- The dynamic nature of the global 3PL marketplace has made it increasingly difficult for large 3PLs to forecast market activity levels. In turn, this has caused ongoing challenges in not only staffing, but also asset deployment. To deal with this problem, many companies are attempting to build much closer relationships with their key customers.

- Regardless of the geographies served, these companies continue to struggle with finding and keeping management talent. Our research has shown that many large 3PLs have a difficult time competing for that talent with other industries that in many cases offer higher salaries, better benefits, lower workloads, and better career development opportunities. While this issue has received considerable attention in the past several years, there is little evidence that it will lessen in intensity and importance in the short-term.

- While the market dynamics in a particular region at any given time may vary considerably, large 3PLs in all three regions will continue to face critical challenges including market selection, right sizing their organizations, integration of acquisitions, price compression, and the need to constantly demonstrate value in the marketplace.

- At the same time, the industry will be challenged to deliver on the promises it makes in the marketplace. Overselling is not uncommon in this industry, and that tends to be most prevalent during economic downturns as companies compete in markets that are either flat or declining. Obviously, that compromises the reputation of the industry in the longer term.

- Large global 3PLs now play an important role in supporting the sourcing, manufacturing, and selling activities of many of the world’s largest, most successful companies. They have established their presence in the world’s largest markets, and their future success will be tied not only to growing their business in such markets, but also anticipating growth opportunities in such areas as e-commerce, health care, and emerging markets – and responding accordingly.

Setting the Stage for the Next 25 Years

As I stated at the outset, logistics outsourcing is now an important strategic option for companies across a wide variety of industries that seek to lower logistics costs, promote efficiencies, and improve service levels. In many instances, users may also be able to reduce capital requirements while focusing on their core competencies.

Over the past 25 years, the structure and scope of the 3PL industry have changed dramatically. Most of the major 3PLs in the marketplace when this research stream began have either been acquired by other 3PLs or failed.

While a limited number of large global 3PLs have emerged to play a vital role in supporting the sourcing, manufacturing, and sales activities of many of the world’s largest companies, the global 3PL marketplace is also populated with thousands of smaller 3PLs serving a wide variety of niche markets.

Looking forward, I believe the 3PL evolution is far from complete. Over the next 25 years, the industry should provide a fertile area for future researchers to continue to examine the industry’s dynamics and its impact on the field of logistics and supply chain management.